NinjaTrader strategy analyzer has many features that you don't always know until after you have worked within the interface for a while...

Seven quick tips for working with NinjaTrader Strategy Analyzer...

Epic Tip 1: Whenever you optimize an algo strategy, you can expand the minimum / maximum properties and type in each field, or simply type directly in the textbox.

It can take some work to go step by step through a strategies properties and setup the minimum and maximum values for optimization... but did you know you can also just type in the textbox within strategy analyzer?

Option 1: Expand the properties settings and manually enter values for minimum, maximum, and the value to increment.

Option 2: Simply type in the values without expanding. The format is min;max;increment. So to increment values from 50 to 200 in increments of 25 it would look like: 50;200;25

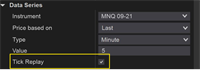

Epic Tip 2: Tick Replay? Maybe not needed with high-fill resolution!

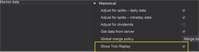

Certain algo strategies (including most Epic Collection strategies!) are coded to take advantage of tick replay, and the strategy results can greatly benefit by enabling this feature. Within NinjaTrader, you can enable the feature under Tools, Options, Market Data, Show Tick Replay.

This option will then be available within the data series when you are setting up strategies or strategy analyzer. To learn more about how tick replay works and the advantages for enabling the feature you can check out the NinjaTrader user guide. https://ninjatrader.com/support/helpGuides/nt8/?tick_replay.htm

Why not always enable tick replay? There is a significant performance impact! Want a better option without the need to have the major performance hit? You can specify the order fill resolution to be set to "High" and choose a value such as every minute or even every second. You might be surprised with how the results are similar to tick replay without the major performance hit.

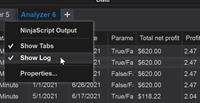

Epic Tip 3: Strategy Analyzer Logs.

By default, you might not even know strategy analyzer had logs... and perhaps that's because they shouldn't even be called logs. When I first heard of the strategy analyzer logs I assumed they were referring to log files I might need to send their support team, or perhaps log files that might include errors the strategies have or a reference that I had to open up in notepad etc...

Well... get ready for a surprise! With all of the work and time that goes into strategy optimization, its a shame when the results just get lost if you don't export or save the results within a template. This is where strategy logs can be helpful.

To enable the logs, you right click within the strategy analyzer interface. You will see an option to "show logs".

Wow! Look mom... I can filter by strategy or by instrument!

Oh... I can also right click within the grid, and open these past historical results within strategy analyzer!

From here you can research all of your past strategies and optimization results... You can "pin" them, and enable features within the "properties" section of Strategy Analyzer to show columns such as the profit factor, or button to view and open the strategy.

Epic Tip 4: Save templates to move between workstations.

When moving between development and production environments, it can be extremely helpful to save templates. Saving templates within strategy analyzer is easy... in the bottom right you will see a "Templates" menu item, where you can click it to open, or save templates. These can then be retrieved when you want to go and enable a strategy within the strategies tab of NinjaTrader, or within the strategies interface within NinjaTrader charts.

So how do you move them from one work station to another? Easy... simply zip up/compress the folders under your templates folder, copy them to the other system, and unzip them. Typically this directory is here: \Documents\NinjaTrader 8\templates\Strategy folder.

We provide a full video that covers this process, including how to take advantage of optimized templates we provide for the best NinjaTrader strategies.

You can check out the video and download templates at http://www.nashtech.xyz/templates.

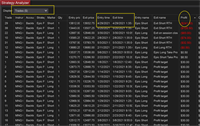

Epic Tip 5: Sort by your worst trades... Add other indicators to the chart to see if you could have avoided that entry.

Often times a strategy has great results and trades great except a couple bad apples that really impact the overall results. You can easily find the worst trades, navigate within the chart for those times and sometimes get a better picture for what might be happening.

For example, many custom strategies we build for clients we often include an overall "max stop loss". This is needed for example if their normal stop loss is set to "last bar high/low", when the previous bar was so parabolic and significant that it really impacted their stop loss.

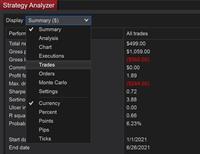

First, navigate within Strategy Analyzer by clicking in the upper left dropdownlist, and select "Trades". Next, check out the entry time and exit time within the executions.

Next, navigate within the "Chart" by selecting that from the dropdownlist. Navigate to that date/time of the entry and see if you can determine anything that would have helped keep you out of that trade? Sometimes this includes adding other indicators on the chart and checking their values. Most of the epic collection of strategies include features to "Opt Out" of trades if the Vortex indicator, choppiness indicator, or ADX indicator are at extreme ranges.

Oh... and if you are trading with the best NinjaTrader strategies and you find your results are just horrible? Just choose the option for trade direction and change it to "reverse" :) All the strategies within the Epic Collection include the ability to trade in reverse if the setup is optimized so poorly you want to actually trade differently.

Epic Tip 6: Backtest against multiple instruments at once, use percent and variables such as ticks rather then fixed currency.

If you discover that similar settings for your strategy work across many instruments, consider testing against many instruments at one time. How do you do this? Well first, hopefully your settings are using input variables such as percentages, ticks, pips, etc... When you have fixed currency type variables its harder to backtest against multiple instruments. Next... When you have selected to backtest or optimize within strategy analyzer, choose the instrument and instead of selecting the single instrument, choose "Select All". This is helpful also if you want to enable the strategy on live simulator accounts as it can create the strategy for each instrument rather you manually selecting each and every instrument. The results will spit out per instrument and save you a lot of time!

Epic Tip 7: Take optimization sloooooowly.

Strategy optimization is powerful... but take when not used properly, it can be a waste of time. For example... what if you forget to select to trade both long and short, and you don't realize this until the optimization takes hours to run? Or after you feel comfortable with the strategy you want to test all different variables and multiple profit targets and stop losses, only to realize when you click run its going to take 70 days to complete! This can easily happen when you define too many variables, too small of increments, etc... Try adjusting the minimum and maximum on just a couple variables to make sure you don't end up with an optimization that takes days to complete!